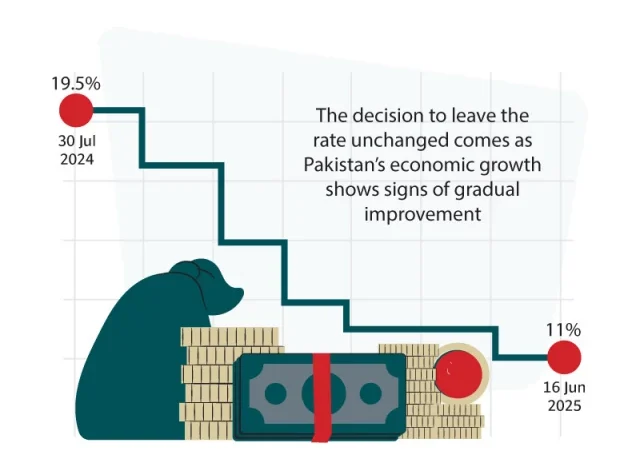

The interest rate held by SBP is 11%.

As it carefully handles a number of economic obstacles, the State Bank of Pakistan’s Monetary Policy Committee (MPC) on Monday opted to maintain the policy rate at 11%. The central bank noted growing risks to the external sector as a result of a growing trade imbalance, sluggish financial inflows, and global uncertainties including unstable oil prices and geopolitical tensions, even though inflation expectations are currently constrained. Subdued agricultural output, a significant reliance on domestic borrowing, and the urgent need for structural reforms—such as expanding the tax base and privatizing public companies that are losing money—are all problems facing the domestic economy. These measures are necessary to ensure fiscal consolidation and sustainable growth.

According to the MPC’s most recent review, headline inflation increased from 0.3% in April to 3.5% in May 2025, which was essentially what was expected. On the other hand, core inflation somewhat decreased, and household and corporate inflation forecasts also cooled. According to the committee, inflation would probably stabilize within the target range of 5% to 7% during fiscal year 2025–2026 (FY26), but it is anticipated to move upward in the upcoming months.

The decision to maintain the policy rate at its current level was made as Pakistan’s economic development began to gradually improve. The government is aiming for an ambitious 4.2% growth in real GDP for FY26, with a provisional estimate of 2.7% growth for the previous fiscal year. Over the course of the upcoming year, the MPC anticipates that the effects of earlier interest rate reductions will continue to ripple through the economy, increasing demand and investment activity.

Notwithstanding these encouraging signs, the committee identified a number of obstacles that might slow the pace of recovery. The two main ones that have increased pressure on the external account are the persistent growth of the trade deficit and slow finance inflows. The MPC also cautioned that the trade imbalance would worsen as a result of certain of the suggested budgetary actions for FY26, such as subsidies or incentives that might encourage imports.

The MPC cited the largely balanced current account situation in April 2025 as one of the most recent economic developments, which increased the total surplus to $1.9 billion over the July–April period. Strong worker remittances, which helped counteract the effects of growing imports and slower exports in a challenging global trading environment, were a major factor in maintaining this balance. The SBP’s foreign exchange reserves increased to $11.7 billion by early June thanks in part to the $1 billion disbursed under the first review of the International Monetary Fund’s Extended Fund Facility.

The exterior picture is still uncertain, though. As domestic demand drives higher import growth and export prospects remain bleak due to ongoing global economic uncertainties, the MPC anticipates the current account to go into a mild deficit in FY26. Furthermore, despite projections that reserves will increase to $14 billion by the end of June 2025, financial inflows have fallen short of estimates. The committee also emphasized the dangers of geopolitical tensions, especially in the Middle East, and fluctuations in global oil prices, which could exacerbate the external sector’s precarious position.

Regarding the budget, the MPC noted gains in FY25’s main and total fiscal balances. Rising income and controlled spending, particularly in public sector development programs (PSDP), have contributed to boost the primary surplus from 0.9% of GDP to 2.2% of GDP this year. The administration has set a greater primary surplus goal of 2.4% of GDP for FY26. The central bank emphasized that macroeconomic stability will depend on maintaining fiscal restraint through successful reforms like expanding the tax base and reorganizing state-owned businesses.

Regarding the real economy, the MPC reported that after a muted first half of FY25 with only a 1.4% expansion, GDP growth accelerated in the second half, reaching 3.9%. The recovery was fueled by the industrial and service sectors, but agriculture trailed behind because of a sharp decline in the production of major crops. With preliminary statistics for the Kharif season pointing to possible setbacks owing to unfavorable weather conditions, the outlook for the agriculture industry is still cautious. On the other hand, it is anticipated that the momentum in industry and services would continue, bolstered by growing imports of machinery and intermediate goods, expanding private sector credit, and strengthening business confidence.

In the monetary realm, growth in broad money (M2) decreased from 13.3% at the last policy review to 12.6% by late May. Reduced government borrowing from the banking sector was blamed for this slowdown. In the meantime, private sector lending increased by 11%, indicating strong demand from wholesale and retail companies, telecommunications companies, and textile companies. Additionally, consumer lending grew steadily, a sign of improving economic conditions.

The seasonal demand for cash during Eid was a major factor in the MPC’s observation of a substantial increase in reserve money growth. The SBP increased its liquidity injections into the banking sector in order to control liquidity and maintain the interbank overnight repo rate near the policy rate.

Because of the earlier drop in global oil prices, energy prices were still lower in May than they were the year before, even with the little increase in inflation. Though their overall inflationary impact is anticipated to be minimal, the central bank issued a warning that recent budgetary moves may cause short-term price volatility. There are still risks to the inflation outlook, such as possible disruptions in international supply chains, changes in local energy tariffs, fluctuations in commodity prices, and geopolitical crises.